John Robb over at Global Guerrillas articulates the importance of energy in Baghdad that I hinted at in the earlier post:

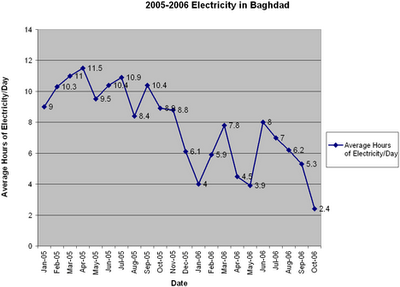

"Infrastructure attacks, particularly on power/fuel/water, negate the ability of the government to deliver political goods (for example, in September Baghdad only received 2.5 hours of electricity a day). This halts economic activity and forces the population to rely upon primary loyalties for daily survival (families, neighborhoods, religious organizations, gangs, etc.)."

Read the whole thing.

Sunday, October 22, 2006

Friday, October 20, 2006

OPEC Surprises No One

Well, as I hinted at in an earlier post it appears that OPEC will cut production in November and possibly again in December. This was impossible to predict, right?

The first cut looks like it will be in the neighborhood of 1.2MM bpd--about 4% of production capacity--with perhaps another .5MM to follow in December.

The first cut looks like it will be in the neighborhood of 1.2MM bpd--about 4% of production capacity--with perhaps another .5MM to follow in December.

Saturday, October 14, 2006

Dollar Rising

The dollar has been on a recent rise against both the euro and the yen. Daniel Kruger's Bloomberg's article seems to take this as a good thing:

"The dollar advanced against the euro and yen for the third straight week as reports on retail sales and consume confidence suggest that the U.S. economy is more vibrant than analysts had forecast."

And indeed, a rising dollar has often been a good thing for the United States. During the last long-sustained period of US economic growth, the dollar was indeed very strong. However, there is a connection then that isn't being seen now. At that time the economy was growing and right now while the US economy is still growing, it's growing at a slower rate. And indeed the US economy is far softer than it appears. The housing market is already feeling slowing effects in most markets and is in retreat in others. The trade deficit is still far beyond historical trends--something that will only be exacerbated by a strong dollar. And the national debt is still growing.

And don't count on continued low crude prices to play a moderating role. I imagine they'll rise back above $60/barrel shortly after the November elections.

So, a rising dollar in this atmosphere? A suckers bet? A cash-out before a landing? It's rather strange, no?

"The dollar advanced against the euro and yen for the third straight week as reports on retail sales and consume confidence suggest that the U.S. economy is more vibrant than analysts had forecast."

And indeed, a rising dollar has often been a good thing for the United States. During the last long-sustained period of US economic growth, the dollar was indeed very strong. However, there is a connection then that isn't being seen now. At that time the economy was growing and right now while the US economy is still growing, it's growing at a slower rate. And indeed the US economy is far softer than it appears. The housing market is already feeling slowing effects in most markets and is in retreat in others. The trade deficit is still far beyond historical trends--something that will only be exacerbated by a strong dollar. And the national debt is still growing.

And don't count on continued low crude prices to play a moderating role. I imagine they'll rise back above $60/barrel shortly after the November elections.

So, a rising dollar in this atmosphere? A suckers bet? A cash-out before a landing? It's rather strange, no?

Friday, October 13, 2006

Clutch Pitching

Josh Levin had an interesting article in Slate a few days ago extolling the clutchness of New York Mets lefthander Tom Glavine. The 40 year old southpaw certainly doesn't conjure the image most of us have when we think of playoff aces--in part because his playoff record is still below .500 and isn't nearly as compelling as his pursuit of 300 career wins (it's quite possible that Glavine will be the last member of that elite club). Additionally, most baseball fans debate clutch hitting, not pitching. Why?

"Bill James, the freelance researcher turned Red Sox executive, says there's a simple reason why everyone wonders about clutch hitters and no one talks about clutch pitchers. "For the same reason that there is more speculation about Bigfoot than there is about lizards," James says. "We know we have lizards."

Last night Glavine did indeed come up big for the Mets. He threw 7 shutout innings as New York took Game 1 of the NLCS by a score of 2-0. Of course, the two runs came courtesy of a Carlos Beltran home run--a player has garnered his own reputation for clutchness.

"Bill James, the freelance researcher turned Red Sox executive, says there's a simple reason why everyone wonders about clutch hitters and no one talks about clutch pitchers. "For the same reason that there is more speculation about Bigfoot than there is about lizards," James says. "We know we have lizards."

Last night Glavine did indeed come up big for the Mets. He threw 7 shutout innings as New York took Game 1 of the NLCS by a score of 2-0. Of course, the two runs came courtesy of a Carlos Beltran home run--a player has garnered his own reputation for clutchness.

Origins

The term "Commanding Heights" goes back more then eighty years. In November of 1922, an ailing Vladimir Lenin addressed the Fourth Communist International in Petrograd in what was ultimately his penultimate public appearance. The year before, he had initiated what was known as the New Economic Policy and was being attacked by communist militants for compromising with capitalism and betraying the revolution. Lenin argued that this was far from the case and that the state would continue to control the "Commanding Heights," or the most important sectors of the economy.

During the interwar years, the Fabians and the British Labour Party quickly adopted the concept and it soon spread throughout the world. Of course, various interests adopted it to their own means in their own fashions. In the US, the government's control over the commanding heights was not so much through direct ownership, though that existed in places, but rather through regulatory enforcement. For most of the 20th Century, statist involvement in the economy's commanding heights was a given and accepted as general orthodoxy.

However, towards the end of the century, it was clear that a marked change of economic practice and been invoked and implemented. Government retreated and the market expanded. Catalyzed through the phenomenon of globalization, trade liberalization, the growth of capital markets, and increasing interdependence have been the hallmarks of this new age. But so too has been increasing economic inequality both between and among nations.

How do we manage the new dynamism and the new insecurity of this century's Commanding Heights? Are the confluence of economic and social forces so great as to challenge our collective ingenuity to effectively manage them? Can we solve the problems of the present and of the future? I believe it is possible.

During the interwar years, the Fabians and the British Labour Party quickly adopted the concept and it soon spread throughout the world. Of course, various interests adopted it to their own means in their own fashions. In the US, the government's control over the commanding heights was not so much through direct ownership, though that existed in places, but rather through regulatory enforcement. For most of the 20th Century, statist involvement in the economy's commanding heights was a given and accepted as general orthodoxy.

However, towards the end of the century, it was clear that a marked change of economic practice and been invoked and implemented. Government retreated and the market expanded. Catalyzed through the phenomenon of globalization, trade liberalization, the growth of capital markets, and increasing interdependence have been the hallmarks of this new age. But so too has been increasing economic inequality both between and among nations.

How do we manage the new dynamism and the new insecurity of this century's Commanding Heights? Are the confluence of economic and social forces so great as to challenge our collective ingenuity to effectively manage them? Can we solve the problems of the present and of the future? I believe it is possible.

Subscribe to:

Posts (Atom)